II. The Reach of Intelligent Freight Technologies

This chapter and the next cover a lot of information. This chapter describes the types of intelligent freight technologies and their connection to key field operational tests (FOTs) sponsored by DOT and others. The next chapter outlines what the freight community has learned about the benefits of those technologies through the tests. To help readers think about potential benefits as they read this chapter, the box below outlines the benefit framework used in the next chapter.

| Direct Benefits to Private Firms |

|

|---|---|

| Direct Public Sector Benefits |

|

| Indirect Freight Network Benefits |

|

Intelligent freight technologies can help monitor and manage vehicles, their contents, and the networks within which they move. As shown in the box, five clusters of technologies can be applied individually or in combination to simultaneously support different stakeholders. As discussed, the asset tracking tools are primus inter pares—first among equals—because they frequently provide a mobile platform for, or critical input to, other clusters.

| Asset Tracking |

|

|---|---|

| On-Board Status Monitoring |

|

| Gateway Facilitation |

|

| Freight Status Information |

|

| Network Status Information |

|

DOT works with freight industries to identify high potential technologies and processes and to support their testing and demonstration. The FOT program has been the centerpiece of this effort since the late 1990s. FOTs focus on near-market-ready technologies in project teams of vendors and users. Most of the FOTs use cost-share partnerships to increase the odds that a project has market-worthy potential and industry commitment. Every FOT receives an independent arms-length evaluation of project performance, costs, and benefits.

Table 1 includes information on six DOT FOTs plus three related projects. Every test included multiple technologies and processes. Appendix A provides information on test reports and points of contact for each project.

| Test | What It Tests |

|---|---|

|

Smart cards, biometrics, and electronic manifests for air-freight terminal access tested at Chicago O'Hare, New York JFK, and Los Angeles Airports. (DOT-funded FOT, 2000-2002) (Reference 1) |

|

E-seals, truck transponders, web-based tracking tested on I-5 corridor between Seattle/Tacoma and Vancouver, British Columbia. (DOT-funded FOTs, 1999-2004) (Reference 2) |

|

Electronic tracking of chassis and containers and web-based port info system tested at Ports of New York/New Jersey. (DOT-funded FOT, 2001-2003) (Reference 3) |

|

Wide-area chassis tracking and e-seal integration tested in Charleston, New York/New Jersey, and in U.S. Department of Defense (DOD) military operations through Norfolk. (DOT-funded FOT, 2002-2003) (Reference 4) |

|

Web portal data exchange wide-area chassis and tracking tested in Oakland and Memphis. (DOT-funded FOT, 2001-2003) (Reference 5) |

|

Tests of multiple technologies including asset tracking to monitor four types of hazmat shipments and show improvements in safety and security. (DOT-funded FOT managed by the U.S. Federal Motor Carrier Safety Administration, 2003-2004) (References 6.A and 6.B) |

|

Two tests that estimated the benefits to shippers of technologies and processes designed to improve security via intermodal cargo visibility. The U.S. Trade Development Agency sponsored the APEC Secure Trade in the APEC Region (STAR) Bangkok Efficient and Secure Trade (BEST) project, and industry sponsored the SST projects. The projects covered shipments from Thailand and Malaysia through the Ports of Seattle and Tacoma, 2003-2004. (References 7.A, 7.B, 7.C) |

|

Test and demonstration of centralized driver identification verification, radiation detection, and container yard management. (Implemented with funds from a variety of sources by Virginia Port Authority, 2002-2003) (Reference 23) |

|

Extensive set of tests and demonstrations focused on global surface container supply chain security. (DHS-sponsored FOT, 2003-present) (Reference 8) |

Asset Tracking

A State highway inspector conducts a safety inspection using wireless hand-held technology to record and receive data. These inspections also facilitate freight mobility. Source: FHWA

Asset tracking capabilities are the core elements of intelligent freight technologies. Although they are not part of every other application, asset tracking can contribute to or interact with nearly all of the other tools. It is worth taking the time to describe the component technologies before discussing asset-tracking applications.

Component Technologies

Critical asset tracking functions include communications, location determination, access to electrical power, and on-board processing.

The type of communications used drives both benefits and costs. Long-distance mobile communications, including satellite and cellular systems, enable high-end benefits based on the ability to report in at any time in the transport cycle. Short-range communications, usually RFID, limit reports to within 100 meters or less of handheld or fixed reader sites. Long-distance mobile communications cost more per vehicle, but the cost is relatively constant per vehicle. Short-range communications usually have modest costs per vehicle accompanied by large infrastructure costs. The amortization of short-range infrastructure costs across a fleet of vehicles and differences in long- versus short-range operating costs can complicate financial analysis needed for making decisions.

Mobile systems need to determine their current location when they record an event or send a message. The most common method is on-board calculation of latitude and longitude with telemetry data from a global positioning system (GPS). Short-range systems are less likely to use GPS because they can derive the location of message events from the known location of the fixed readers that collect the data.

The source and stability of electrical power is important to the design and usability of tracking technologies. Tractor-based mobile systems have it easy, drawing their power from the tractor's electrical system. Some trailer- and chassis-based systems can trickle charge their batteries when tethered to a tractor, but must depend on a battery when untethered. Active RFID devices, those that can initiate communication, must have a battery. Passive RFID devices can be battery-free because they derive the power they need from the energy in the signal from a reader. Passive devices may use a battery to boost the signal.

Batteries raise concerns about duration, field replacement, and cost. Mid-lifecycle battery replacement in the field is an operational burden and a meaningful barrier to asset tracking deployment for long-life assets, such as marine containers. Battery technologies are improving, offering longer life. Elegant tracking device designs can reduce the demand for power, effectively extending battery life. Solar cells and trickle chargers also offer promise, but raise their own issues of vulnerability to damage and inattention.

Asset tracking devices cover a wide range of on-board processing power. Some mobile long-range systems include dedicated on-board computers, while others have simpler microprocessors. Examples in connection with on-board status monitoring technologies are discussed in this report. Active RFID systems include at least sufficient processing power to decide when to initiate a search for a reader, and passive RFID systems usually have the most rudimentary processes, such as testing the integrity of a seal when queried and powered by a reader.

Asset Tracking Applications

Freight transportation assets include conveyance power units, trailers, chassis, containers, pallets, cartons and individual items. Depending on the stakeholder and the business issue, each level of aggregation can benefit from more accurate and timely tracking information.

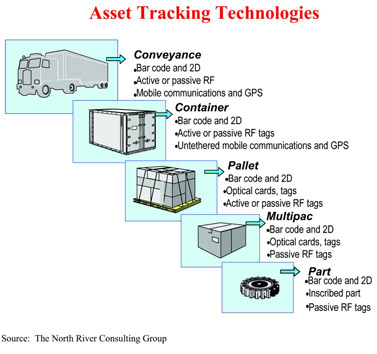

Key: 2D = two dimensional, RF = radio frequency, GPS = global positioning system

An end-to-end freight movement usually involves changing relationships at a level of aggregation; for example, pallets of LTL (less than truckload) freight link to different trucks and trailers as they move from pickup to linehaul to delivery. Because of this, the persistent historical challenge of freight operations management is maintaining correct and current relationships among the levels of assets in each movement. That is the essence of intransit visibility. Figure 1 illustrates that challenge, showing the need to track each level of aggregation and the relationships among them. The figure also shows tracking devices used at each level. These devices range from active telecommunications to traditional visual bar codes and labels.

Tractor and truck tracking with mobile communications and location determination is highly advanced and productive in many segments of the trucking industry. About 15 years ago, the innovators were the irregular route truckload carriers, which reaped significant benefits per tractor per year and transformed these technologies into industry best practices. As costs drop and successful experience continues to accumulate, usage has been spreading to other industry segments, including LTL and drayage.

The Hazmat FOT applied mobile communications to track truck and trailer combinations with tangible success, as discussed in the next chapter. The U.S. Department of Defense (DOD) and the U.S. Department of Energy (DOE) also use these technologies to track commercial carriers that haul their sensitive freight. The Defense Transportation Tracking System (DTTS) monitors shipments of arms, ammunition, and explosives, and DOE's Transportation Tracking and Communications (TRANSCOM) System monitors radioactive waste shipments (References 24 and 25).

Many truckers use tractor-mounted RFID transponders, but less for fleet tracking than for compliance facilitation and toll payment. Some of the Pacific Northwest FOTs piggybacked off those applications to monitor the progress of containers drayed along the I-5 corridor between Seattle/Tacoma and the Canadian border. The FOTs used the State of Washington's port-to-border crossing "TransCorridor" transponder network to track progress as trucks passed under reader antennas at weigh stations, port terminal gates, and border crossings.

Chassis and trailer tracking marries mobile tracking technologies to these dependent conveyances. First generation products faltered around the turn of this century because of technical performance and battery issues, but the biggest barrier has been economic. The CEO of the largest U.S. truckload carrier said in 1999 that he thought "the next revolution" in fleet management would be untethered trailer tracking, but the costs were not yet right. By 2004, second generation digital products gained more acceptance in the market, with roughly 80,000 units in commercial use.[2]

The Cargo*Mate and Freight Information Highway (FIH) FOTs tested a near-market ready container chassis tracking system called Cargo*Mate. It packages GPS, cellular communications, sensors, and a battery within the chassis frame to improve the visibility and management of chassis fleets and, when they are loaded, the containers and cargo associated with the chassis.

The HazMat FOT tested untethered trailer tracking, but the focus was less on fleet efficiency than on using the technology to ensure the security and safety of high hazard commodity shipments.

Container tracking is a close cousin of chassis and trailer tracking from a technical perspective, but it faces more challenging hurdles because of the nature of the international container industry. While chassis and trailers are unlikely to leave the United States, let alone North America, the free-flow global nature of the container business makes it much harder to recover the value of an investment in a maritime container—the investor cannot count on repetitive use of the same container.

In the mid-1990s, DOD began to use active data-rich RFID tags to track ocean going containers and air-freight pallets. As a large shipper concerned about the visibility of its freight, DOD loaded manifest information onto the data rich tags. Readers at terminals and gateways throughout the world provide location information.

Electronic seals are used to ensure shipment integrity and to track cargo. Typically electronic seals are used on high-value loads, agricultural products, and other shipments requiring enhanced security. Source: FHWA

The Pacific Northwest FOT used electronic cargo seals (e-seals) as surrogate container tracking devices, but two other tests went further. The Asia Pacific Economic Cooperation (APEC) Bangkok Efficient and Secure Trade (BEST) project assessed an RFID e-seal for both security and asset tracking; thirty containers were instrumented and tracked from Bangkok into the Pacific Northwest. A privately funded set of pilots, the Smart and Secure Tradelanes (SST) initiative, instrumented over 800 container movements on 18 trade lanes. The BEST and SST tests yielded intriguing benefit estimates that are discussed in the next chapter.

At the case and pallet levels, shippers have begun to implement simple passive RFID "license plates" to improve the visibility and management of their supply chains. Most of these initiatives are built around the electronic product code global tag standard developed by the Massachusetts Institute of Technology AutoID Center and its industry partners. Commercial compliance has been the principal trigger as dominant buyers, including Wal-Mart, Target, and DOD, mandated that major suppliers begin shipping tagged goods in 2005.

Route adherence monitoring is a special application of asset tracking. Geofencing, as it is often called, uses algorithms to analyze and display location data, enabling commercial dispatchers and conceivably law enforcement officials to quickly address exceptions such as route deviations, entry to restricted areas, and developing schedule failures. Geofencing can work with any mobile communications-based tracking of tractors, trailers, and chassis. The HazMat FOT assessed geofencing, and both DOD's DTTS and DOE's TRANSCOM System use it successfully.

Looking across the freight levels in Figure 1 and their asset-tracking technologies, it seems likely that in a few years auto-nesting technologies will be used in the field. RFID readers aboard trailers will record the loading and removal of freight, and associating shipments automatically with the trailer and then with a tractor. (References 18 and 20).

On-Board Status Monitoring

There are established and growing demands for on-board status information related to freight vehicles and their cargoes. Most solutions simply collect sensor data to transmit en route or store for download at the destination. More robust solutions collect the data, evaluate it, and trigger autonomous actions without prior authorization from central dispatch. An extreme example of the latter, developed in South Africa, is a series of internal pepper gas dispensers to discourage thieves who trigger trailer intrusion detection alarms. A more benign example is automatic restart circuits on refrigerated containers.

Some truck fleet operators use sensor data on vehicle operating parameters, from engine revolutions per minute to highway speed, from tire pressure to brake wear. The information helps managers anticipate maintenance problems and reinforce safe and efficient driver behavior.

The use of commercially oriented cargo and freight condition sensors is well established. Perhaps best known, temperature sensors and recorders improve the quality and accountability for perishable shipments. Pressure and toxic sensors enhance the safety of hazmat shipments. Accelerometers tied with GPS help ensure that rail and highway impacts and shocks stay within contracted limits, assign responsibility for problems, and map problem patterns. The Cargo*Mate FOT extended the concept, including change-of-status detection for tethered or untethered chassis.

Antiterror-oriented cargo and freight condition sensors are less well-established. Explosives and radiation detection technologies are reasonably dependable, but cost-effective biological agent sensors are not on the horizon.

Intrusion and tamper detection sensors have a long history, traceable to the Phoenicians. The simplest devices in use today, metal or plastic indicative seals, are the direct descendants of ancient wax and terracotta seals that, by damage or absence, implied tampering. Intelligent freight technologies start by marrying electronics to the security basics of indicative and protective barrier seals.

E-seals test the integrity of their closure for tampering and report the results to a reader, usually via RFID. The Pacific Northwest FOTs included both simple disposable e-seals and "dual-capability" devices acting as security seals and truck transponders. Seals were usually placed on in-bond containers in Seattle and Tacoma after a CBP or agricultural inspection, then monitored until crossing the border in Blaine, Washington. The Northwest FOTs showed the efficacy of e-seals and laid the groundwork for the Hazmat FOT, which integrated some of the e-seals to report through mobile truck and trailer communications. The SST phase 1 review showed how early startup problems, both technical and training, could be corrected during the course of a deployment (Reference 7.C).

Container and trailer security devices (CSDs and TSDs) are generally RFID devices that are more complex than e-seals. Their technical foundation is usually a magnetic or pressure-based door sensor tied with an internal light sensor to detect entry through a container wall or ceiling. The CBP "Smart Box" test has been working with one type of CSD since January 2004, and Operation Safe Commerce tested other variations. The most aggressive development in this area is the Advanced Container Security Device program, a DHS research and development initiative aimed at developing cost-effective "six wall" intrusion detection systems (References 11 and 21).

Remote locking and unlocking systems attempt to elevate security beyond that of a traditional external lock or bolt seal. Some of these systems are akin to small bank vaults, with multiple sliding rods to secure the container or trailer doors. Some omit any external access point so that thieves or terrorists would not know where to drill to access the locking device. The remote control strategies range from electronic contact "keys" or personal digital devices with programmable access codes, through local RFID controls, up to wide-area monitoring and command via cell or satellite communications. Radio remote control locks may integrate geofencing information from the asset tracker to preclude unlocking except at specified coordinates, such as the proper destination.

RFID transponder-based placards are possible for hazmat loads. These tools could enable first responders at the scene of a hazmat incident to quickly identify the commodity and proper procedures. Technology is less the issue here than is the need for coordination among the hazardous materials regulators and stakeholders.

Emergency call buttons are tools that enable drivers to summon aid to their location with a single click. The technology is available as a wireless remote device that drivers can take with them during a rest stop, or it can be mounted in the truck cab. The core technology is relatively simple: a pre-programmed function on the on-board computer or communications system captures the GPS location and sends a "mayday" message. Additional functions tested in the HazMat FOT include automatic vehicle shutdowns via the engine governor, fuel line, or air brake system. In-cab emergency call buttons have been standard and successful parts of the DTTS and DOE TRANSCOM System programs for several years.

Triggers and barriers. Not surprisingly, the deployment of on-board technologies tailored to commercial concerns, such as vehicle operating and cargo condition sensors, has been driven by economic interests and perceived ROI. The situation is similar for some of the anti-theft technologies. The mix of triggers and barriers is more complex, however, for security devices aimed more at reducing risks of terror attacks.

Gateway Facilitation

This set of technology applications improves operations at terminals, inspection stations, and border crossings. They weave together threads of security validation, regulatory compliance, and operating efficiency.

Driver identification and validation is an essential function at freight pickup points, intermediate delivery terminals, and even at destinations. Intelligent freight technology and process innovations aim to improve the effectiveness of the function, reducing the risks of theft and terrorism while facilitating gate and reception processes, especially for drivers who make frequent pick ups and drop-offs at the terminal.

Biometric identification tools, such as fingerprint and iris recognition, may be incorporated in smart identification (ID) cards and integrated with on-line access to manifest, vehicle, and driver databases. The ESCM FOT applied this approach with notable success, and the HazMat FOT built on it. Looking ahead, the Transportation Security Administration (TSA) Transportation Worker Identity Card (TWIC) aims to deploy a common biometric smart ID card for all U.S. transportation workers.

Non-intrusive inspection technologies enhance security inspections by imposing smaller efficiency and cost penalties than traditional manual methods. X-ray and gamma ray scanners help CBP and law enforcement officials search for contraband, illegal aliens, and threats to homeland security.

Compliance facilitation applications can be doubly attractive, enabling tangible efficiency benefits for both commercial and governmental stakeholders. The applications can facilitate both state highway and NAFTA land-border crossing inspections.

The building blocks are RFID transponders aboard trucks, pre-registration of load and shipment information, integration of regulatory databases, and networked readers, sensors, and inspection stations. Automated exchange of permitting and licensing information sets the stage for automated screening of trucks at weigh stations: RFID readers pull truck mounted transponder information; the system immediately checks on-line databases and flashes no-stop green lights to known compliant vehicles. Safety and weigh stations in 30 states employ technologies that conform to DOT's Commercial Vehicle Information System Networks (CVISN) program.

Customs and border crossing facilitation is a variation of automated data exchange and database interrogation but with more factors in play, including agricultural controls, advanced manifest compliance, and other homeland security issues. The Pacific Northwest FOT applied these processes and technologies to in-bond container movements.

A transponder mounted in the cab of the truck relays information to the roadside electronic reader through antennae in the overhead structure. Source: FHWA

Weigh-in-motion is a subset of compliance facilitation, using sensor technology that permits calculation of truck weights without stopping on fixed scales.

Electronic toll payment systems mesh an asset tracking RFID transponder and reader with secure access to on-line financial databases. In cases such as EZ Pass in the northeast, several states and toll authorities made policy and institutional changes in order to recognize transponders and settle financial accounts across state lines.

Triggers and barriers. Compliance facilitation applications have been an "easy sell" for carriers because the benefits of reduced stops have been clear and the costs of adding transponders have been modest. The barriers are a bit more formidable for driver identification and validation applications because of the time it is taking to finalize the TWIC program.

Freight Status Information

These applications aim to facilitate the exchange of information about freight shipments among commercial and government stakeholders. The approaches include enhancing the standards for data elements and message sets and evolving information exchange protocols to eliminate speed bumps in data flows.

There are already active examples of commercial and public sector web-based freight portals. Carriers and third-party logistics companies offer Web sites to their customers for equipment reservations, rates, shipment status, and pick up information (Reference 19). Several port authorities and private firms, such as e-Modal, mix web access to port-based information, such as ship arrivals, with terminal gate congestion information (Reference 3). The Pacific Northwest FOT deployed a prototype Web-based border and port terminal screening system, the Trade Corridor Operating Systems (TCOS), which integrated CVISN transponder and e-seal reader network data. TCOS was the focal point that enabled users to cross-reference data and link key information for customs clearance. The DOD DTTS and DOE TRANSCOM System also provide web access to state and tribal officials who track high hazard shipments through their jurisdictions.

Better standards for intermodal data exchange definitions are a necessary foundation for moving beyond today's portals. Given the global nature of trade, the United Nations Trade Data Element Dictionary is an important building block for standard cross-modal data definitions. Electronic Data Interchange (EDI) message formats, a fundamental data exchange tool that has been used for two decades, still leave gaps to bridge between competing standards and across modes of transportation. The FIH FOT tested a new approach for freight data information exchange among the transportation modes. The FIH included a new set of data transfer standards and applications that enabled the automated translation of railroad and ocean carrier EDI business data exchange formats into a format called TranXML, facilitating interoperability (Reference 5).

Web services software offers another step ahead, providing a software system designed to support interoperable machine-to-machine interaction over a network. The software functions as a gateway between proprietary trading partner systems, facilitating automated interfaces using XML. Web services software was one of the concepts tested in the FIH FOT, and it will play a much larger role in the new EFM FOT (Reference 22).

A standard electronic freight information transfer is a logical complement to better data element and exchange standards, and it can be a big step toward removing those speed bumps in freight data flows. The ESCM FOT, not surprisingly given its title, was built around an internet-based manifest for land-air freight shipments. The standard information transfer structure, together with the biometrics and other elements of the FOT, produced significant benefits and set the stage for the new EFM FOT. The new FOT's goals include formalizing the information transfer standard for truck-air-freight interfaces as an intentional step towards a universal EFM.

Triggers and barriers. Progress on freight status information applications has been positive but muted. Web-based portals make clear contributions, but struggles for competitive and proprietary advantage limit industry-wide solutions. Better standards and information transfer formats may make sense to industry leaders, but tedious standards development processes, jockeying for competitive advantage, and resistance to change slow progress.

Network Status Information

In an era of increasing congestion, with a consensus that we cannot build our way out of the problem, it is essential to make the best use of available transportation capacity. Technologies that collect, manage, and exploit network condition data are tools to that end.

Congestion alerts and avoidance are a fundamental capability of many Intelligent Transportation Systems that are useful to many transportation stakeholders and especially important to freight operators in and around crowded gateways, such as ocean terminals and border crossings. Current data from cameras, road sensors, and other sources can be fed into predictive models and distributed via Web portals and other means. The Freight Information Real-Time System for Transport (FIRST) FOT displayed videos of terminal gates and surrounding roadways for subscribers in the Port of New York/New Jersey. Vancouver, British Columbia, and the Virginia ports in the greater Hampton Roads area have operational systems with similar capabilities (References 3 and 23).

Carrier scheduling support is closely related to the transportation Web-based freight portals and congestion alerts and avoidance. Fleet and terminal manager software systems may be programmed to incorporate feeds from regional congestion monitoring portals. At the low end, dispatchers simply pass along bottleneck information to drivers, but the higher end may include dynamic adjusting of trip schedules and strategic shifts in operating policy, such as moving to more nighttime operations.

Network status information and asset tracking capabilities can be integrated with software and display technologies to support first responders to safety, homeland security, and traditional law enforcement incidents. Dispatchers can use these tools to help get the right resources to the right locations as quickly as possible. This capability was tested successfully in the Hazmat FOT with a commercial operations center that passed alert information to appropriate public emergency services personnel.

Triggers and barriers. The situation is similar to freight status information: positive but muted progress. Freight operators seem to welcome public investments that provide information on congestion and traffic conditions, but barriers impede data pooling and sharing. FIRST, for example, could not transition to an operational system because of stakeholder concerns about protecting proprietary information and defending proprietary data systems.